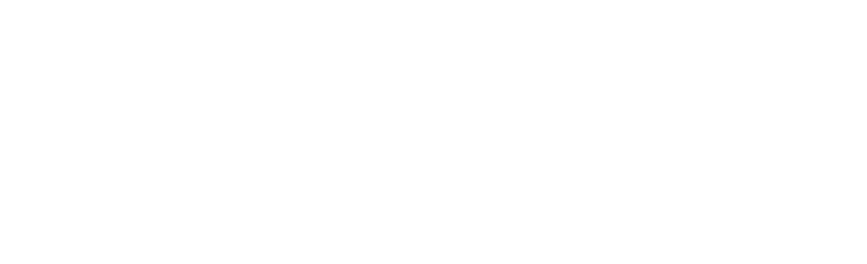

Consolidated statement of profit or loss

Consolidated statement of profit or loss

for the year ended 31 December

| 2021 | 2020 | |||

| Note | AED’000 | AED’000 | ||

| Interest income and income from Islamic financing and investing assets | 11 | 180,945 | 210,006 | |

| Interest expense and profit distributable to depositors | 11 | (43,749) | (56,542) | |

| ————————- | ————————- | |||

| Net interest income and income from Islamic financing and investing assets | 11 | 137,196 | 153,464 | |

| ————————- | ————————- | |||

| Fee and commission income | 12 | 29,251 | 36,657 | |

| Fee and commission expenses | 12 | (13,388) | (10,994) | |

| ————————- | ————————- | |||

| Net fee and commission income | 12 | 15,863 | 25,663 | |

| ————————- | ————————- | |||

| Net insurance premium earned | 129,840 | 145,694 | ||

| Net commission paid | (9,705) | (14,089) | ||

| Net insurance claims incurred | (66,636) | (84,212) | ||

| Other underwriting expenses | (11,608) | (4,867) | ||

| ————————- | ————————- | |||

| Net insurance income | 41,891 | 42,526 | ||

| ————————- | ————————- | |||

| Net investment income | 13 | 25,008 | 31,493 | |

| Credit impairment loss on loans and advances | 20 | (52,892) | (72,273) | |

| Credit impairment loss on Islamic financing and investing assets |

21 |

(200) | (1,825) | |

| Other operating income – net | 14 | 26,534 | 22,346 | |

| ————————- | ————————- | |||

| Net operating income | 193,400 | 201,394 | ||

| ————————- | ————————- | |||

| Salaries and employees related expenses | 15 | (102,846) | (121,954) | |

| Depreciation of property, fixtures and equipment | 25 | (13,450) | (15,208) | |

| Interest on lease liabilities | (23) | (171) | ||

| General and administrative expenses | 16 | (51,417) | (42,854) | |

| ————————- | ————————- | |||

| Operating profit for the year | 25,664 | 21,207 | ||

| ————————- | ————————- | |||

| Share of loss of equity accounted investees | 22 | (2,906) | (307) | |

| ————————- | ————————- | |||

| Profit for the year | 22,758 | 20,900 | ||

| ————————- | ————————- |

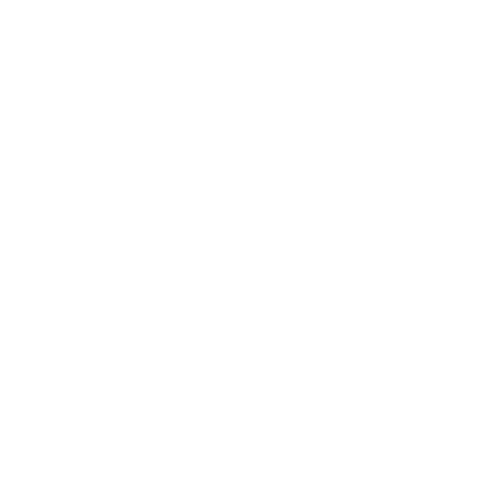

| 2021 | 2020 | |||

| Note | AED’000 | AED’000 | ||

| Profit for the year | 22,758 | 20,900 | ||

| Other comprehensive income:

Items that will not be reclassified to profit or loss: |

||||

| Gain / (loss) on changes in fair value of financial assets carried at fair value through other comprehensive income | 63,139 | (14,719) | ||

| (Loss) on disposal of financial assets measured at fair value through other comprehensive income | (2,102) | – | ||

| ————————- | ————————- | |||

| Other comprehensive income /(loss) for the year | 61,037 | (14,719) | ||

| ————————- | ————————- | |||

| Total comprehensive income for the year | 83,795 | 6,181 | ||

| ============= | ============= | |||

| Profit attributable to:

Equity holders of the parent |

15,484 | 13,965 | ||

| Non-controlling interests | 7,274 | 6,935 | ||

| ————————- | ————————- | |||

| 22,758 | 20,900 | |||

| ============= | ============= | |||

| Total comprehensive income attributable to: | ||||

| Equity holders of the parent | 72,677 | 381 | ||

| Non-controlling interests | 11,118 | 5,800 | ||

| ————————- | ————————- | |||

| 83,795 | 6,181 | |||

| ============= | ============= | |||

| Basic and diluted earnings per share | ||||

| attributable to ordinary shares (AED) | 17 | (0.01) | (0.02) | |

| ============= | ============= | |||

The notes on pages 15 to 113 are an integral part of this consolidated financial statements.